BLOG

Date:

17/05/2021

Location:

New South Wales Sydney

Strata offices in the Sydney CBD tipped to soar in value when towers are demolished for metro stations

Sydney CBD

The Sydney CBD office market is set to be thrown into more turmoil as a result of the NSW government’s announcement that it will buy several commercial office buildings to make way for the city’s new metro west stations.

Some in the industry believe that it will lead to a price and rent surge as the estimated 180-odd office owners that will be kicked out of their premises jostle to find new places to base their operations. Others predict it could prove a blessing for those looking to reduce their space in the wake of COVID-19.

“The market had been tracking quite well even before this, as low interest rates have driven many business owners into wanting to buy office premises rather than lease them,” said Tim Noonan, director of Noonan Property, who has been selling CBD strata property for the past 20 years.

“But now the market is so small, you couldn’t find 180 empty offices. So, those businesses will be chasing a very limited number of available strata offices. That’s good for existing owners as prices will rise, but it could be harder for tenants of people looking to buy because they might find space getting more expensive.”

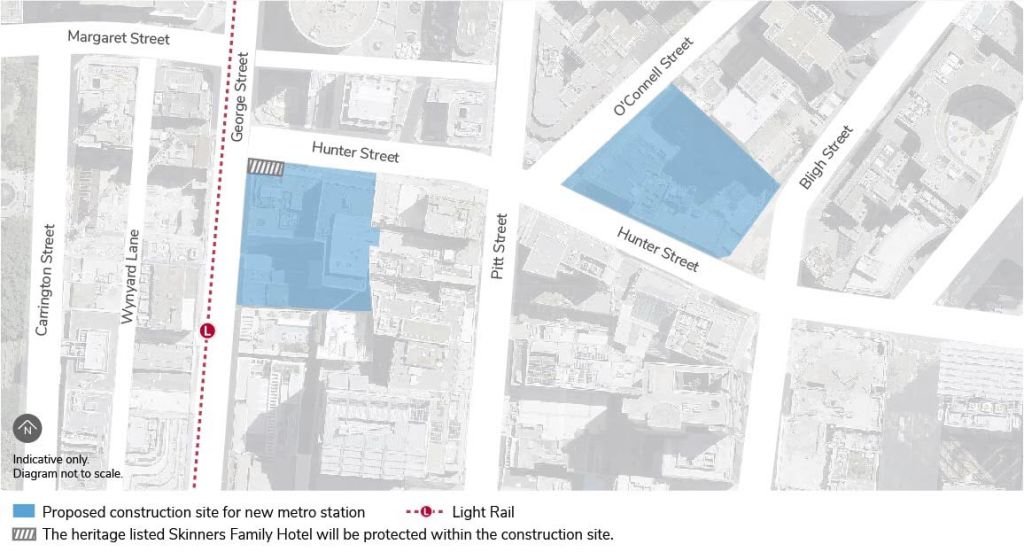

The NSW government announced on May 12 the location of stations for the $27 billion Sydney to Parramatta metro west line at Pyrmont and Hunter Street in the CBD, and this would necessitate the purchase of 13 buildings, including shops and cafes, to make room for them.

Among those buildings will be 15,400 square metres of strata office space in the buildings at 37 Bligh Street, the refurbished 43-lot 300 George Street and 5 Hunter Street, above the Hunter Connection food court. Those offices are thought to be collectively worth about $300 million.

But Mark Lockwood, director of transaction management at Tenant Representation Services, said more stock had become available in the CBD as a result of COVID-19, with the amount of available office space growing from 50,000 square metres to 300,000 square metres in the past 18 months.

“The last time there were major compulsory acquisitions, which started in 2016, they took away a lot of B-grade space and rents went up significantly,” he said. “But this time, there’s a lot more space on the market, so the impact on rents will be less.

“It will also give some tenants an opportunity to re-evaluate their business needs. But there’s no doubt people need to be nimble and work with a very good tenant representative to help them find space.”

One of his clients, Gareth Gammon, chief executive of specialist insolvency and business recovery specialists Jirsch Sutherland, has been negatively affected by the compulsory acquisition. His own leased offices at 28 O’Connell Street, which he moved into just six months ago, are in one of the buildings set to be demolished.

But he agrees that others might welcome the ability to get out long leases and downsize their space.

“Given the current economic climate for many tenants, these changes could prove an opportunity to consolidate their leasing arrangements and move into more appropriate premises,” Mr Gammon said.

“It will involve disruption and throw longer-term plans into jeopardy but for other people, it could be a ‘get out-of-jail-free’ card. As insolvency specialists, we’ve been working with numerous businesses who have been under pressure in terms of being hamstrung with their leases when they might need less space.

“But we’ve yet to see how the office space market will pan out. With these buildings taken out, some landlords may look for a premium, but with new office space coming on. No one really knows.”

Mr Noonan still believes the market for strata offices will become tighter. He says the commercial strata office supply in the Sydney CBD is made up of about 100 buildings, with about 400,000 square metres of office space – roughly 10 per cent of the city’s total office supply.

The strata sales market has continued to perform well throughout the first half of 2021, with positive sales results in all price points throughout the Sydney CBD, he says, including the highest commercial waterfront sale of $14.6 million at Walsh Bay in May.

Yet prices will rise further now, he believes, and the price jump could persuade developers to start building more offices in the CBD, or to buy other buildings to convert them into strata-ed commercial space.

“There hasn’t been any buildings converted to strata-title office space for almost 10 years,” Mr Noonan said.

“One of the reasons for that is that freehold owners, if they’re looking to sell, want to sell in one line as an investment opportunity as the market for freehold buildings has been so strong; stronger than for strata buildings.

“But now, with the government buying these buildings, that might swing that around a bit more. There might be more demand for strata offices in this new situation, they might consider strata title.”